Online Registration Procedure How to File Income Tax Returns eFiling or IT Returns Filing Online Registration at www.incometaxindiaefiling.gov.in website….

Income tax is percentage of your total income which is slashed by the government either directly or indirectly. The funds are directed to the development of the nation by giving proper infrastructures, quick developments, free medication and school facilities. They government pays salaries to state work both in central government and the state. The income tax has a lot of uses to common individual or citizens. This by getting all the services from government through the contribution one makes towards the income tax. As a responsible citizen must file your IT Returns Filing to your nearest Chartered Accountant.

Every day’s tax or monthly earning give high contribution to government income. The ministry of finance manages the tax even to the levels of central board of direct tax (CBDT). The income tax is calculated annually but generated monthly. IT Returns Filing is most important in India. Everybody who are crossed 4-5 lakhs per annum mandatory to file the Income Tax Returns.

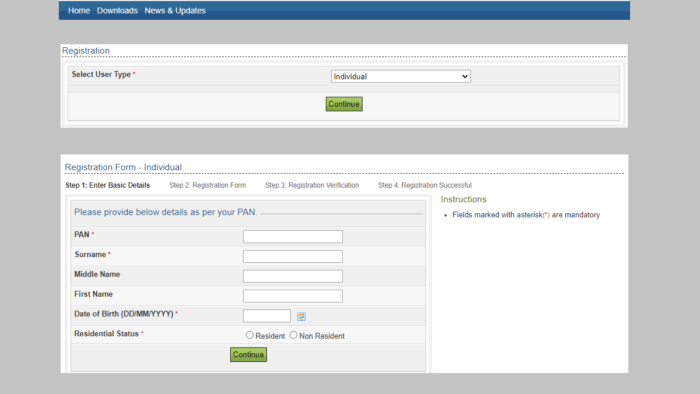

IT Returns Filing Filing Online Registration (Income Tax Returns) in www.incometaxindiaefiling.gov.in?

The government and ministry of finance though has made it easier for individuals to access the official website. You can fill your own tax at the comfort of your own house. You only need the right documents then register at the portal after this you do the simple process.

What documents are needed to Income Tax Returns Filing or IT Returns Filing in India ?

- Aadhaar card.

- PAN card.

- Your bank account details.

- Form 16.

- All your investment particulars.

- If you have children give their tuition fee especially 2 children.

- A receipt of your house rent if applicable.

- Home loan details and certificates indicating loan details.

- The medical receipts for you and the dependents.

- Any donation if applicable

Registration process

- Go to official website: https://www.incometaxindiaefiling.gov.in/home

- On the home page select new e-filling from the menu bar.

- There will be options of the user type: Individual and Hindu undivided family.

- Now fill your personal particulars: PAN Number, Your Surname, Middle name, First name, Your date of birth, Residence/permanent address etc, Fill all the mandatory spaces on the registration form, Recheck the details you’ve entered then submit, When you are done a message will be sent about successful process and Check your email for user ID and for password.

IT Returns Filling after registration at www.incometaxindiaefilling.gov.in

- First login to the official website; https://www.incometaxindiaefilling.gov.in

- The page will open up since you had registered enter your user ID and password sent on your email.

- Fill the captcha code to proceed.

- The form will open now check on ‘prepare and submit ITR online’. Click on the tab

- If applying individual filling select ITR form. The tax may be from your salary, pension, family pension or lottery. The funds maybe up to Rs.50lakhs.

- Now filling the details as follows: The general information, Gross total income, All the deductions and the income totals, Get the sum which is taxable, Other data: advance tax, assessment on tax payments and About TDS.

- Now after fill the information on all the parts check the details again.

- Upload your signature online commonly known as the digital signature certificate.

- The process of e-filling is done. Note if you can’t upload the signature download the manual form sign then email it to the income tax offices. This has to be completed within 120 days.

- Some refunds might happen they will be sent via the same address given in the registration process.

- The website is open payments though the debit/credit or internet banking online. They should be directed to the income tax department.

There are various ways to filling your returns

- Using the official government site.

- Fill in the forms manually and take them to the offices.

- Use the H&R block India.

How do I link my Aadhaar card to pan?

With a lot in the new technology the Income tax has introduces many systems. First the official website: https://www.incometaxindiaefilling.gov.in . They later came up with idea of linking the Aadhaar card to the PAN. However there 2 ways to link the card: without logging to your account and by logging in to your account.

Online linking method of the Aadhaar and PAN

Without logging into your account

- Visit the official website page: https://www.incometaxindiaefilling.gov.in

- Select the Aadhaar link on the menu bar after the page opens.

- Give your PAN and Aadhaar number now enter the names as they read on both cards.

- Submit the details the system from the UIDAI will give a verification. They will confirm the Aadhaar number.

Logging into your account method

You need to be registered on the IT Returns filling portal. https://www.incometaxindiaefilling.gov.in

- Navigate to the website portal: https://www.incometaxindiaefilling.gov.in

- When the page opens enter your user ID and the password. This is given when you register continue by entering the date of birth.

- Now that you have login the screen will bring a site o link both cards Aadhaar card and the PAN.

- It might not respond go to the menu bar on top bar click profile setting link the Aadhaar.

- The personal details will reflect on the screen as they were registered on the e-filling portal.

- Now confirm the details on the screen if they reflect the same on the Aadhaar card.

- If the details are the same please key in your Aadhaar number and the Captcha code.

- Select the link now button and proceed.

- A success message will pop up showing the procedure is successful.

Linking the Aadhaar number with PAN using SMS

With all efforts from the government and the income tax offices, they urge all citizens to Link your Aadhaar card to PAN card. They have ensured to bring simple ways like SMS to fit even the common citizen and those who don’t have vast knowledge of internet use.

- The process is simple and will take the shortest time possible.

- Send the SMS to 567678 or56161 using the registered number.

- UIDPAN<12digit Aadhaar>>space><10 digit PAN>

- UIDPAN123456797656AKPLM2124M

The process is simple and the results will be send immediately on the successful link of both cards. For more information you can visit th e official website: https://www.incometaxindiaefiling.gov.in/home