Instructions on How to Link Aadhaar Card Number to Pan Card Number or Aadhaar Number to PAN Number Linking at https://www.incometaxindiaefiling.gov.in/……..

The government gave a strict warning of cancelling or the pending cards. If so happens individuals will have to apply again for both the Aadhaar and the Pan cards. The citizens have heed the call of government and almost all have either linked to the mobile number or to the pan card. Candidates who want apply for a Loan? Our Central Government started a PMEGP Loan Scheme.

How do link Aadhaar card Number to PAN card Number?

This has become mandatory, as earlier said you can’t pay your income tax without linking the two cards. Additionally if you need more the INR 50000 you need to link this card to transact in the bank. There are several ways to link your Aadhaar Card Number to Pan Card Number.

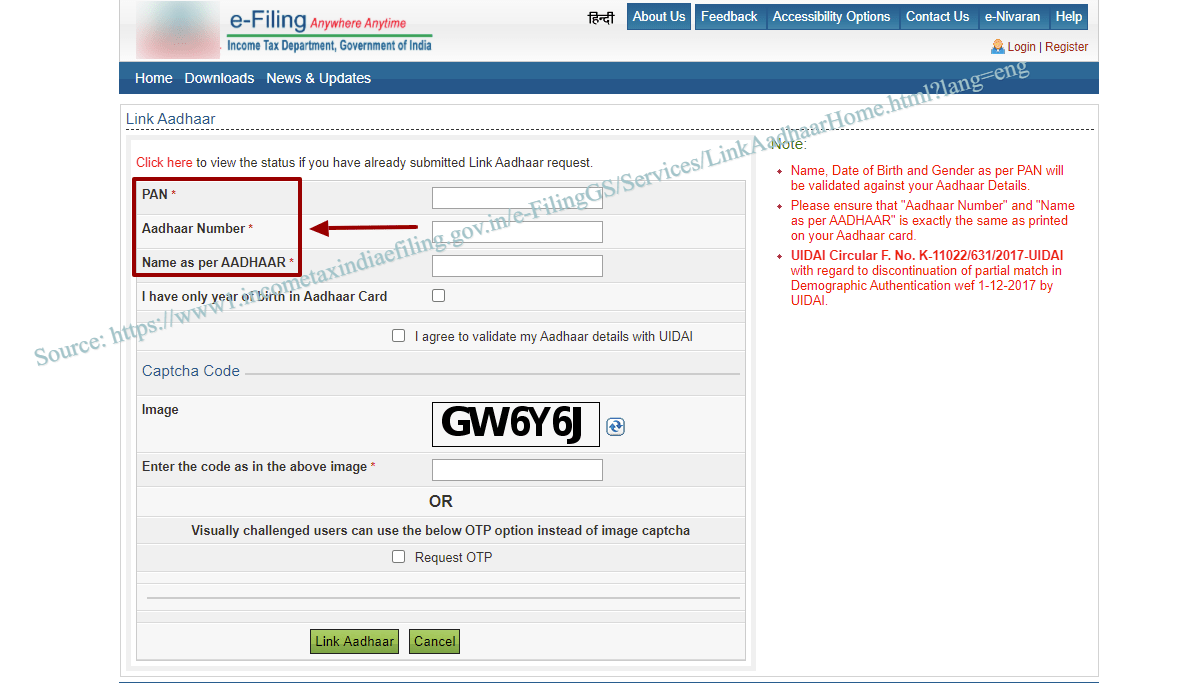

Linking the Aadhaar Number to Pan Number online at e-filling website

- Visit the official website page: https://www.incometaxindiaefiling.gov.in/home

- Key in both your Aadhaar Number and the PAN card number on the form which appears on the screen.

- Key in your name as you registered on your Aadhaar card.

- If it happens your year of birth is the only one appearing then you have to tick on a square provided.

- Enter the Captcha code given on box in the same form.

- Now select the ‘Link Aadhaar’ tab.

- After a few seconds a message will pop on the screen indicating successful link.

Note the system cares for the visually challenged individuals. They only need to request for OTP, it will be send on their phone. They can use it instead of the captcha code on the box.

NSDL process

- Go to the NSDL website portal

- It will bring a new page for you to correct your name or any other error on the pan card.

- Submit the document on the same portal. It will update all the details as you want them.

- The NSDL will confirm the details and send them via email address, you can now link the Aadhaar card again.

The UIDAI process

- Navigate to the UIDAI website page: https://ssup.uidai.gov.in/

- On the page key in your Aadhaar and security code.

- The system will send an OTP on your registered number.

- Note if you are only changing the name you require the OTP. However if it’s the other details you have to send supporting document.

- They will be approved then the linking process can be repeated.

What is the importance of linking the PAN card with Aadhaar Card?

- The government made it clear all cards which are not linked will be deactivated after March 2018.

- It will curd fraud cases, like people having many cards with different names.

- You can’t process your income tax return if you haven’t linked the cards.

- You can’t transact on your bank account any amount past RS 50,000.

- You can get income statements if you have link the two cards.

How to link the Aadhaar card Number with PAN by using SMS

How to link Aadhaar Number with PAN by sending SMS?

UIDPAN<12DigitAadhaar>10 Digit PAN> Send this message to 567678 or56161. This will only work if your number is registered. Example of the SMS linking process. Aadhaar number: 1234 5678 9103 and PAN alpha-numeric is: ADCBE1243G. Type: UIDPAN 887554327012 ADCBE1243G send to 567678 or 56161

How to correct the errors in the linked PAN and Aadhaar card?

If there are any mistakes which occurred when linking or matching differences on details in the PAN and Aadhaar card. The process won’t take place, you need to correct the mistake so you can link again. All the solutions are in the UIDAI website or the NSDL CONFIRMATION OF THE pan details.