Central Provident Fund Cpf Singapore, CPF Contribution calculator, CPF Interest Rates, CPF Balance by CPF Login into www.cpf.gov.sg website….

The CPF (Central Provident Fund) is a retirement benefit scheme for the employed Singapore citizens. It’s a secure way of saving where the employee and employer contribute to the fund. CPF doesn’t just meet the retirement needs but also the health, insurance, investment, education and housing necessities.

The scheme is dived into three accounts namely:

- Ordinary account OA

- Special account

- Medisave account

| Type of account | purpose | Interest rates |

|---|---|---|

| Ordinary account | Housing , insurance, investments and education | 3.5% p.a |

| Special account | It entails retirement products, it’s met for old age. | 5% p.a |

| Medisave account | Matters to do with hospitalization, medical insurance. | 5% p.a |

| Retirement account | This a special one you get the account on your 55th birthday doesn’t apply for age lower than this. | 5% p.a |

The rate include 1% p.a an extra interest which is from the first 60 000$ of all the combine CPF balance. Those in the retirement account also will start earning an extra 1% interest on the first 30,000$ of the combine balances. With 20,000$ of the ordinary account thus adding up to 6% p.a.

Calculations or CPF Calculator

Ordinary wages (ow): This the basic salary earned by all salaried citizens. It is counted as 6,000$

Additional wages (aw): This are bonuses and allowances on top of our salary.

AW subject to CPF =total wages-OW subject to CPF

Total wages is give at the range of $6,000 *17= 102,000 per year.

If an employee earns $ 8,000 every month and a bonus of $50000 his / her calculation are as follows.

AW =$102000-OW subject of the CPF for the whole year. 102,000-(6,000*12) = 30000$

This is equal to 17 months *$ 6,000

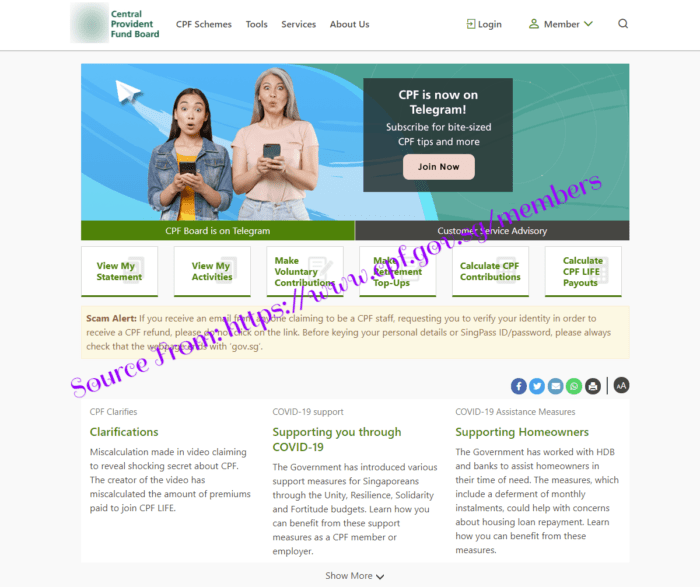

How do I login for the Central provident fund (CPF Login) at www.cpf.gov.sg?

The employed citizen have an easy access to their CPF accounts. It can be done online by just connecting to the internet. To login you need your submission Central Provident Fund number following the correct order. Then get your e-service online you can then proceed to set-up the e-service online.

- Visit the official website https://www.cpf.gov.sg

- On the menu you will find e-services. Click on it and search for CPF.

- Here you have to take the option of e-service submission and continue.

- Fill in your particulars carefully.

- Check all the details then submit online.

What to find in the Central Provident Fund Singapore website

When you open the site you will get various employees benefits. You will have some employees requesting for Central Provident Fund life schemes. There are schemes for applying retirement benefit after the official age of 55. The employee will gain more money at the retirement benefit.

- Build my investments.

- Self-employment needs.

- HPS.

- Next of kin details.

- About death and also medical situations.

- Education.

How do I check my Central Provident Fund Balance or CPF Balance Statement at www.cpf.gov.sg?

- Navigate to the official website: www.cpf.gov.sg

- Move to the bottom of the page and you will find popular services.

- On this tab check my CPF balances.

- Click on the tab, it will start checking the balance on the Central Provident Fund website.

- There Is a tab written login here

- Key in you Singpass ID and password, then login in.

- A new page will appear and you’re supposed to submit the OPT on the space.

- Take an option of My CPF on the homepage.

- You can now view your last three transaction here.

- A balance statement can be generated for you to have a hard copy.

- Request for transaction details from the options give on the page. This the date from when you want to know and the transaction done.

- Click on the submit button and you will receive all the details.

How do I reset CPF password at www.cpf.gov.sg?

Sometime we forget the important details like passwords and login ID. This are the crucial documents for us to access the website and have our inquiries addressed. The Singapore government has set everything you need to know and how to recover your password. Follow the simple steps below.

- Select the official website www.cpf.gov.sg

- Go to the menu bar, select my account.

- Choose the option of services.

- You will get an option of reset password.

- Follow the instructions, an OTP will be send to your registered mobile number.

- Key in on the space provided.

- You can now compose your new password, repeat the password and submit.

- You get a verification message.

- Note you can’t repeat the same passwords as before and the OTP has to be fill within 2 minutes of receiving it.

How to Calculate CPF Contribution and How to Logon CPF Login at www.cpf.gov.sg?

How to CPF Login at www.cpf.gov.sg website?

On your browser, type www.cpf.gov.sg and press enter to access the CPF website. Once on the CPF website, click on ‘Login’ button that is found on the home page. This action will automatically redirect you to a different page on the website from where you can login. Enter your SingPass ID and password then click on “Login” to login into the CPF website.

How to Calculate your Income Net CPF?

Calculating your income Net CPF can be easily completed on the CPF website or by using online tools that are available for free. Regardless of the option that you decide to use, the final results will always be the same.

How to use CPF Calculator?

CPF Calculator is a detailed calculation of the monthly reimbursements that you will be paid by the government once you have retired and stopped paying the CPF funds. The CPF calculator is based on the amount of savings that an employer or employee has accrued within a given time.