Telangana State Government Life Insurance TSGLI Policy Status Details at http://tsgli.telangana.gov.in/, TSGLI Policy Annual Account slip, Search your TSGLI Policy Bond Details using Policy Number………

About TSGLI (Telangana State Government Life Insurance) – The scheme was started in 1907 By the Nizam of Hyderabad, the scheme was started as welfare scheme for the welfare of older Government employees. The names of the scheme have changed from time to time. Earlier it was as the family pension fund, the name got changed to Hyderabad state life insurance fund. It was further changed to Andhra Pradesh Government life Insurance fund in 1956.

One can check most of the details of his policy online by accessing the following links. Please find below the procedures for the respective purpose mentioned below:

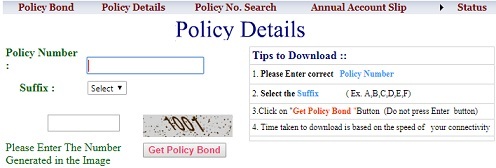

Procedure for Checking the TSGLI Policy Bond details in http://tsgli.telangana.gov.in

One can download and also check the details of the policy through website using following process:

- Go to the website of TS Government Life Insurance web page: http://tsgli.telangana.gov.in/

- Enter the correct details of the policy number in the space provided

- Select the correct suffix from the drop down as per the policy.

- Correctly enter the numbers that are displayed by the captcha

- Click on get policy bond.

- Time of download of policy would vary depending on the speed of internet. Also for downloading ensure that POP blocker is on for the website by going to the internet tools.

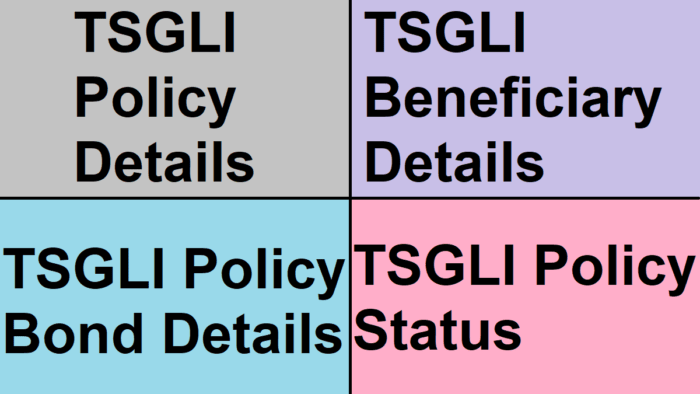

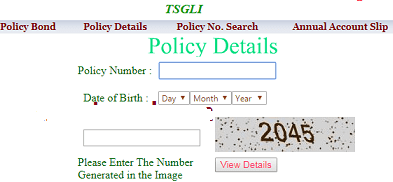

How to know my TSGLI Policy details using Policy Number, DOB at tsgli.telangana.gov.in

You can also check the TSGLI policy details search with your policy number and Date of Birth:

- Go to website of TSG Life Insurance site URL: http://tsgli.telangana.gov.in/PolicyDetails.aspx

- Enter the correct policy number in the space provided

- Enter the date of birth mentioned in the policy details

- Correctly enter the numbers displayed by the captcha

- Click on the button “view details” to see the details regarding the policy.

TSGLI Policy Number search using Policy Account Holder name

In case you have forgotten your policy details. You can use the link to get the policy number from the website. Please use the following procedure for policy search:

- Go to the Telangana State GLI portal: http://tsgli.telangana.gov.in/PolicyFinder.aspx

- Enter the part of your name as mentioned in the policy e.g. Chandra for Chandrashekhar

- Enter the part of the name of you father

- Enter your date of birth, same as mentioned in the policy

- Correctly enter the numbers displayed by the captcha image

- Click on the button “Retrieve Policy No”

This will help you retrieve the policy number in case you have forgotten the same. This number can now be used to fetch the details of the policy as well as for downloading the policy from the website.

How to search TSGLI Policy Status using TSGLI Policy Number at tsgli.telangana.gov.in

There have been occasions earlier where the policy premium was cut from the salary but was not credited into the policy premium account. If anything like this happens, one can simply check on the website and report it to the head of his department. One can also download the annual account slip. One needs to follow the following procedure to check the policy status:

- Go to the official website of http://tsgli.telangana.gov.in/Status%20of%20Applicant.aspx

- Enter the correct TSGLI policy number in case you don’t know or you have any doubt click on policy details tab to fetch the policy number

- Enter the section from the drop down like issue of policy/ Loan/ Claim

- Enter the financial year for which you want to fetch the details

- Correctly enter the numbers displayed by the Captcha image

- Click on ‘view’ to fetch the account summary.

TSGLI department is under the supervision and control of the Finance department. TSGLI is a scheme for social welfare and security of the government employees and is necessary for all the government employees and provincial local body employees. The Insurance policy under TSGLI has the following unique features:

- Telangana state government employees who are in the age bracket of 21 to 53 years are eligible for making use of this policy

- The policies issues by TSGLI are endowment policies which are ,matured one day before a person attains 58 years of age

- TSGLI policy does not lapse and have a very low rate of premium

- One also get an exemption under income tax section 80C on the premium paid under TSGLI

- TSGLI is known to provide attractive bonus rates to the policy holders. The current bonus rate is rupees 100 for every 1000 rupees of sum assured every annum.

- One can get a loan of up to 90% of the surrender value in TSG Life Insurance

- Loans under TSG Life Insurance are provides at a very low rate of simple interest of 9% per annum.

- At the time of maturity, the policy holder gets the total amount which includes the sum assured and the bonus accrued till the maturity period

- Since the policy is for the government employees only, in case the policy holder ceases to be the government employee and the person decides to surrender the policy. On surrendering the policy, one gets the surrender value and the bonus accrued on the policy till that time.

- In case of death of the insurer before the maturity of the policy. The full assured amount along with the bonus accrued till the death of insurer is paid to the legal heirs of the person.

TSGLI has come up with good schemes for Government employees which provides safety in case of any miss-happening as well as providing good returns and bonuses.