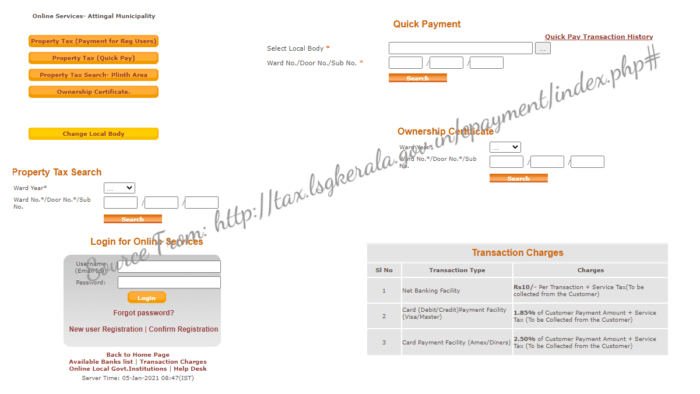

Guidelines on Paying Kerala Property Tax Online epayment and Apply Ownership certificate by Sanchaya Online Services Portal at http://tax.lsgkerala.gov.in/…

We have Kerala property tax online to discuss. The property tax matters have been address and are overlooked local and state government. They have the official website link which takes a lot of services in the state. The https://lsgkerala.gov.in link is a public portal where the tax and marriage, death and other services are dealt with. Citizens don’t have to visit offices to pay for their property rather they just login to the site and complete task online.

How do I Pay Kerala Property Tax Quick ePayment Online at tax.lsgkerala.gov.in?

Initially the Kerala state citizens used to visit the revenue officials to register their property. It was alt of hassle since there were long queues and also a lot of corruption. This wasn’t enough the documentation was poor thus leading to the loss of documents. This lead the government introducing the Kerala property tax website which is known as the Sanchaya.

Here property owners can register, change details and also make payments. It has made the situation much easier and one can open the link anywhere. We have the online procedure which is the most popular way to make payments.

- Enter https://lsgkerala.gov.in on your browser. This is the official web portal for opening The Revenue and License Department of Kerala State Government website. Press the enter button on your keyboard to initiate this search.

- On the homepage of this website, scroll down until you see ‘Property Tax e-Payment’ option. Click on this option, which will then redirect you to a different web page on your browser.

- Click on ‘Payment for Registered Users’ option. This action will redirect you to the login page of the Revenues and License website (Sanchaya).

- Enter your username and password in the spaces set aside for these details. The username is usually your Email Address. If you do not have an account, you will have to click on ‘New User Registration’ option.

- Here you will fill in all the details correctly after which you should click on ‘Submit’ button. You will then be able to view your username and password in your email. Use these details to access your account.

- Click on the ‘Login’ button after correctly filling in all the login details.

- On the homepage of your account, click on ‘Enroll a Building’ option. You will see this option from the Property Tax menu.

- Select the District and Institution type from the drop down box that appears on your screen. Click on ‘Search” button after selecting these details.

- You will then have to select the Online Local Government Institution from the new drop down box that appears. Scroll down the options given until you get your Local Government.

- Click on the “Go” button that is beside the Online Local Government Institution that you want.

- On the new page, that appears on your screen, select the ‘Ward Year’ and ‘Ward Number’. Click on the ‘Search’ button after filling in these details.

- Click on the ‘Select’ option in the dialogue box that appears before finally clicking on ‘Add’.

- After enrolling your building, you will have to make the Property Tax Payment. To make this a success, click on ‘Online Payment’ from the ‘Property Tax’ menu.

- You will then have to select ‘Pay Now’ option that is besides your building name.

- Next, click on ‘Pay Now’ on the new page that will be displayed on your screen. Wait for a few seconds or minutes for the payment to be processed.

- Select the payment method and click on ‘Make Payment’

- You will receive a One Time Pin in your registered mobile number. Enter this OTP to authenticate the transaction before finally clicking on ‘Submit’. The online payment of Property Tax is now complete.

Downloading process of an Kerala Ownership certificate online in tax.lsgkerala.gov.in

Using the Sanchaya website which is an e-governance software you can now receive the ownership certificate. This a major service under the Sanchaya site under the Kerala state government.

- Go to the Home page: https://tax.lsgkerala.gov.in

- When the page open select the district and corporation/municipality from the menu.

- The search button will be displayed click on it for the system to search for the corporation.

- A new page will open and here you find the ownership certificate option.

- Click on this option and the site will ask for your ward year, ward number and door number.

- Select the search button again and the system will open a new page with the owner’s details according to the ward number.

- The website will only show if you paid for the property tax to get the ownership certificate.

- If the payments are done now select the ownership certificate.

- A new page opens select the purpose of the ownership certificate. In few seconds the certificate will be produce but in PDF.

- After this you can print or download the certificate for future reference.