Telangana EC Status Online at registration.telangana.gov.in and Telangana Encumbrance Certificate Search (TS EC Search) at Telangana Registration and Stamps Department….

What is Encumbrance certificate? This a legal document which is required in buying property. It stands in for the title deed of the property or a document showing full details of a property. Most individuals in the Telangana state wish to own property. However you need to have an EC to get the property. The document is used as security for a loan and other legal activities.

The Registration and Stamps Government of Telangana is now making use of the internet to improve their service. Below are some of the services that you can get in Registration and Stamps Government of Telangana Website.

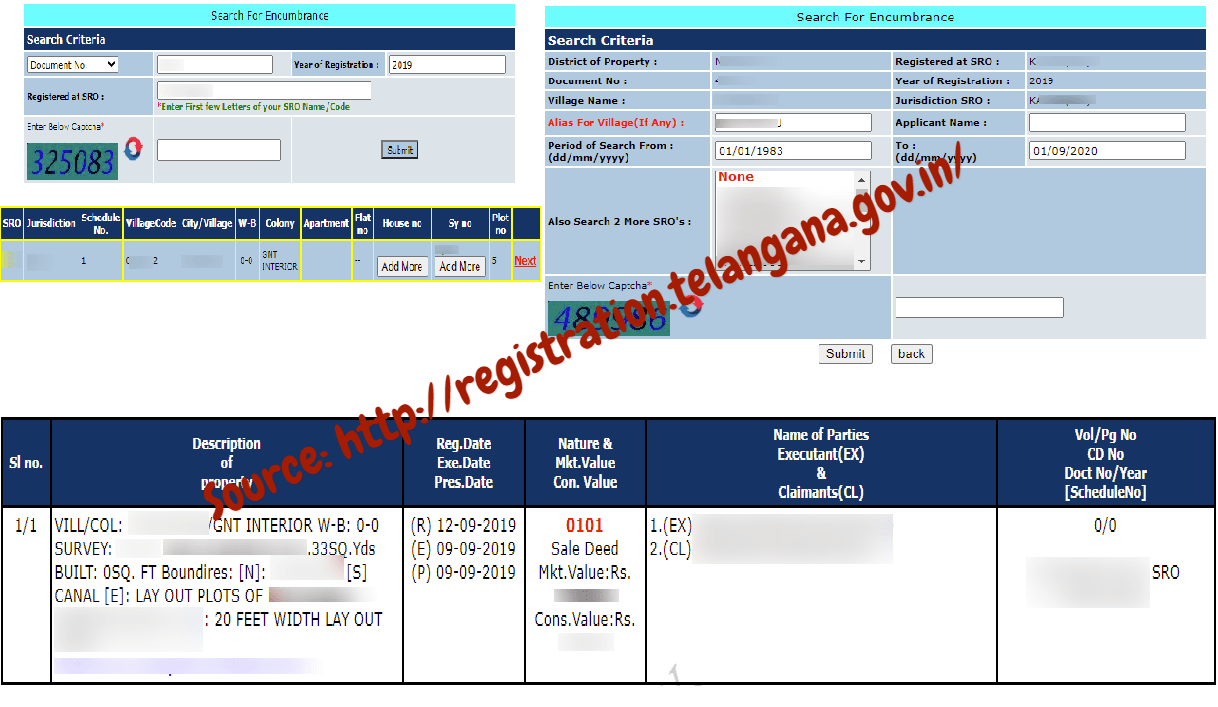

Telangana EC search or Telangana Encumbrance Certificate Search at registration.telangana.gov.in

Resident of Telangana can now search for Encumbrance Certificates (EC) online. To perform this action, you will have to follow the simple explanation given below:

- You will first have to use https://registration.telangana.gov.in/ as the official link for accessing Registration and Stamps Department Government of Telangana Website.

- Click on ‘Encumbrance Search’ link from the Online Services menu in the homepage of this website.

- You will be redirected to a new page from where you can see the Encumbrance statement. Click on ‘Submit’ after going through the statement.

- Next, select the type of option that you wish to use i.e. Document number or Form Entry. You can select ‘Document Number’ before filling the number and year of registration.

- Enter the first few letters of your SRO name or code in the space set aside for this detail. Click on ‘Submit’ after filling every detail correctly.

- Click on ‘Next’ in the drop down box that will appear.

- You will then have to fill in your name before clicking on ‘Submit’ button.

- Finally, select the ‘Document ID’ by clicking on the checkbox. Click on ‘Submit’ to get your statement of Encumbrance property. You can print the statement by clicking on ‘Print’ button.

How to check Telangana encumbrance certificate Status or Telangana EC Status at registration.telangana.gov.in

- Visit the Telangana Registration and Stamps Department website

- Select encumbrance certificate which is on the right side of the menu.

- Select the submit tab.

- Then a new page will appear look for the encumbrance and fill all the details needed. Example the document number, year of the document.

- Submit the details after rechecking them for correction.

- Now select the encumbrance certificate need then submit the information.

- The details will be shown at a copy for future reference.

- This website page has vast information and also deals with stamp duty, how to calculate and payments of the stamp duty.

How can I search the TS EC through the documents?

How to search the Telangana EC through the following documents?

The document number. The year the document was published. The house number it can be old house number and the location either the city or village. Note if using house number follow this procedure: ward, block and Door number or House Number Survey number which is determined by the plot number. You have to give the district name and the SRO office for every category.

How to check the registered document information at registration.telangana.gov.in?

Go to the Homepage of the website: http://registration.telangana.gov.in. Select the registered document option on the menu bar. Give the registration information of the registered number. Choose your district. Also pick your sub-registration office. Now enter the document number. Lastly fill the year of registration.