Apgli.ap.gov.in Track your Andhra Pradesh Government Life Insurance APGLI Policy Status Details, Annual Account slip, Search your Policy Bond Details using Policy Number….

The Andhra Pradesh Government Life Insurance (APGLI) Department is one of the highly esteemed and oldest department in the state. The scheme was established by Nizam of while earliest government of Hyderabad. In the year 1970 to cater for the welfare of his employees. However an organized managing committee was set to run the scheme under the title of Family pension fund. Not long and they renamed the scheme to Hyderabad state life Insurance fund in the year 1913.

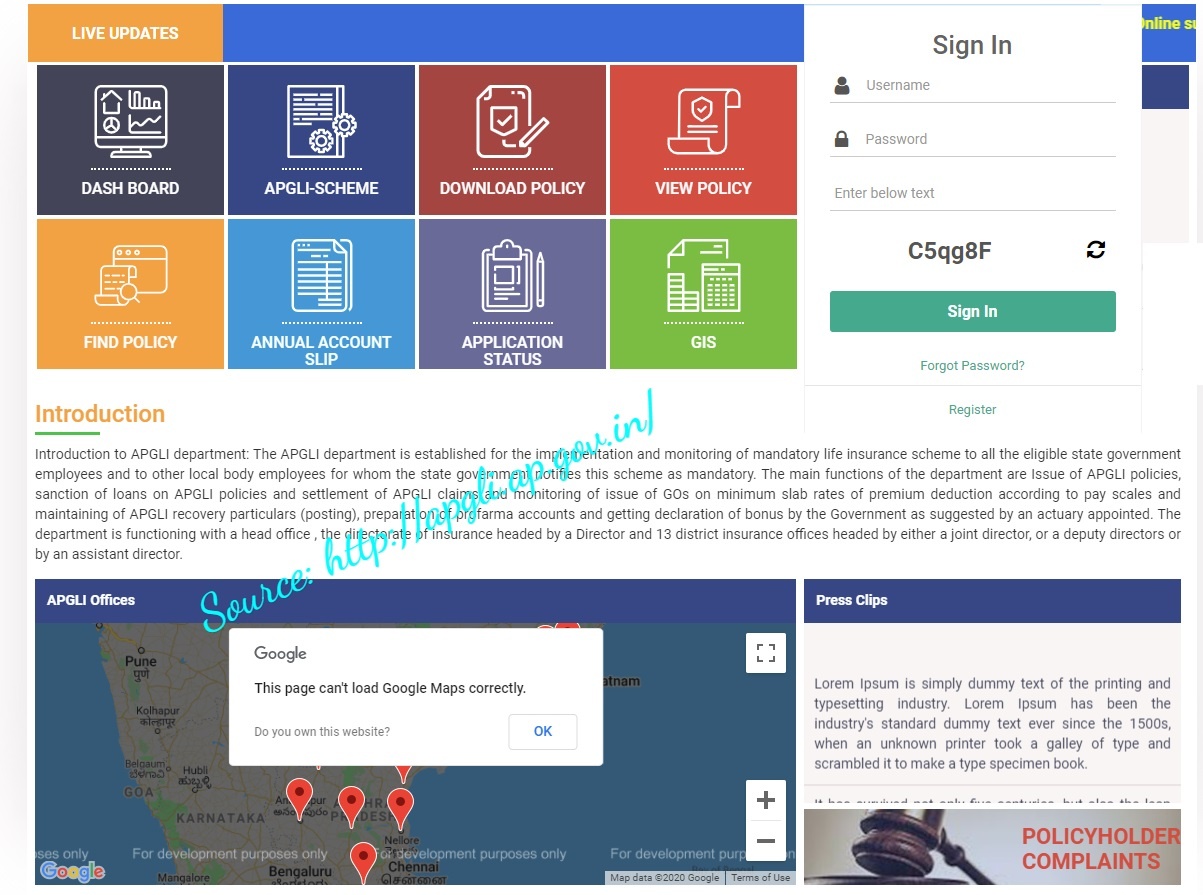

APGLI policy bond goes online

The Andhra Pradesh state life insurance department, has come in handy to help all the government employees. They have introduced online issue of policy bonds making it easier for the workers and the government. They can visit the official government website, http://apgli.ap.gov.in and download the policy bond. The launching of the system by the Finance minister Buggana Rajendranath assuring the employees proper service. He said the APGLI has huge deposit of Rs.3400 crores, and already 23 districts can have full access of their policies online. This was taken up well by the workers hoping the system will take motion fully.

Annual account slip

Sometime is proper to check your premium entries per year to check whether the sums are adding up. This helps know what interest is gained annually. The process has simple clear steps:

Click on the APGLI service portal. http://www.apgli.ap.gov.in/

- Key in your policy number.

- Enter the correct financial year.

- Enter the captcha number

- Press view report.

- A page appears and the full statement is displayed.

The government has raised up orders which will govern the APGLI scheme, they decide that any state employee from the age of 21-53 is eligible to apply for this compulsory life insurance. The will mature at the age of 58 one day before the actual age. The government made order to be followed strictly. This funds help in the retirement and have different features:

- Start saving soon as you get employed from age of 21-53.

- You will receive whole amount at the age of 58.

- The scheme doesn’t collapse and has been there ever since 1907

- The premium rate are low.

- Big bonuses at the end the premium period.

- The policy holder will receive the money on maturity.

- Be sure to receive the rates and the bonus when you leave or cease being a government employee.

- Fast transaction of the bonus and rates when you get the age of 58.

These are some of the features of the APGLI which is a legal scheme for the government employees.

How to download APGLI Policy Bond using your policy number and How to Get APGLI Policy Bond Details at apgli.ap.gov.in

How to take print APGLI Policy Bond using policy number at apgli.ap.gov.in?

First of all just follow the government official website: http://apgli.ap.gov.in. Then Enter valid policy number. Key in your date of birth (dob). Enter the Captcha code as shown on your Monitor. Click here to follow http://www.apgli.ap.gov.in/PolicyDetails.aspx

How to Get APGLI Policy Bond details online at www.apgli.ap.gov.in?

Log on into the APGLI official web portal: http://apgli.ap.gov.in. Key in policy details. Enter your policy number. Then date of birth. Enter the Captcha code as shown in the box. Click view details and new page will get the APGLI Policy Bond details.

How to Check APGLI Policy Status by policy number in apgli.ap.gov.in?

Hit the government official APGLI link: http://www.apgli.ap.gov.in. Start with the policy number. Name of the applicant. The financial year like 2008-2009-2010. Enter the captcha code. Request policy status. A page will show your status.

How to get your AP Government Life Insurance APGLI policy number details online at apgli.ap.gov.in?

To learn about your details you have to follow a simple procedure and with few seconds you can observe them on your device or compute. Navigate to the official government website. http://apgli.ap.gov.in. Key in your policy number. Key in the date of birth. Enter the number on the captcha. The details will appear on the page.