Simple Instructions on How to GST Login Online Registration for Tax Payers at www.gst.gov.in and services.gst.gov.in….

GST is an indirect tax in the Indian state for the goods and services supplied. It is the largest tax transformation in the state. This type of tax has generated a lot of income for the Indian government. Good and services tax has taken in smaller taxes like the: Service tax law, VAT, Entry tax, Octrol and The central excise law.

When was GST formed? Some countries in the world implemented the system earlier and have being doing well economic wise. The Indian state took the initiative to implement the GST in 1st July 2017. It has gone strong by picking the both the central and the state tolls. With this the government divide the taxes in four sectors according to the state or central government as follows:

- SGST: State GST tax collected by the state government.

- CGST: Central GST the tax is collected by the central government.

- IGST: Integrated GST the tax is picked by the central government.

- UTGST: Union territory GST it collected by the union territory government.

All this Acts were introduced by the government in parliament as money bill.

Benefits of the GST in India

- It brings together the Indian state in economic wise and in the national market.

- It has help the export market and the manufacturing of the goods which upgrades the country’s economy.

- GST offers more jobs thus creating employment to the Indian citizen and eradicating the poverty state of livelihood.

- It has brought a unison tax level for both the SGST and IGST rates.

Benefits of the GST to the Local Consumers

- All the Indian citizen have something to smile about the GST has made simple tax system.

- The cost of goods and services are low considering the removal of the rates attached before the GST was introduced.

- The whole system is transparent and clear to all citizen.

- The GST system has brought by new chances of employment.

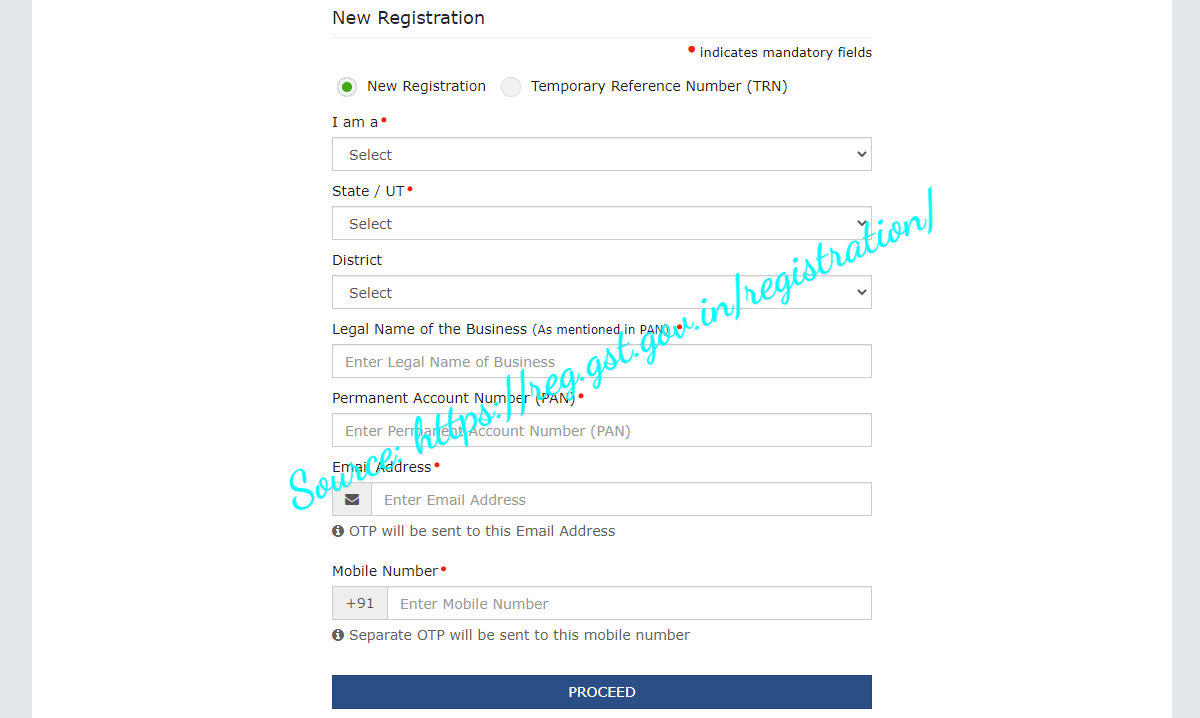

How to Signup for GST Login Registration Online at www.gst.gov.in

Here are the steps to Join for GST Login Registration. Procedure are as follows….

- Go to the official website: https://www.gst.gov.in

- The home page will open and on the menu bar the ‘Services’ bar will show.

- Then Select ‘Registration’. Then click on the ‘New Registration’.

- A new page will appear showing new registration select the practitioner button.

- Choose your district and state from the menu.

- Key in the name, pan, emails and mobile number.

- Type the Captcha code as shown in the Box

- Select the proceed button.

- The page will be change where you get an OTP verification.

- You will get the OTP on your mobile phone or email address.

- There will be 2 OTP enter them and select proceed.

- The TRN will be produced instantly. Then click proceed.

- Now enter both the captcha and the TRN and continue.

- Key in the OTP you got on the mobile then select proceed.

- Give all the details need in this part and then upload in pdf format.

Services provided in the GST portal services.gst.gov.in

- Registration: Citizens who have an income of 20 lakhs in any year should apply for the GSTIN. You will receive an ARN number which can be used for tracking your status.

- Payment: The website portal has a chance to get a challan to pay the GST. Enter your CPIN and get your status on the payments.

- Refunds: The portal helps individuals to get the refund application status.

- Notifications and Orders: All the taxpayers can access the portal if they are registered. Notices will show when they login and get orders too.

- Time limitation: Every eligible person in tax paying has time limitation the Act gives a duration of 30 days from your registration date. Past this date the state government and the levy act takes serious action towards the tax payer.

How to Search Taxpayer Using GST Number in https://www.gst.gov.in/ Website

GST registered dealers may sometimes want to perform a GST Number (GSTIN) verification before you can finally enter it in your GST returns. With the GST website, you can now perform this action online without seeking the help of a third party. Below is a systematic explanation on how to search taxpayer using GST Number in GST Website.

- Enter https://www.gst.gov.in/ on your browser as the official link for accessing GST Website. This link will redirect you to the homepage of Goods and Services Tax website.

- Place your mouse cursor on ‘Search Taxpayer’ option. This option can be clearly seen on the menu bar of GST Website.

- You will then have to click on ‘Search by GSTIN / UIN’ option. A new page will appear on your screen.

- Enter GSTIN / UIN of the taxpayer after which you should click on ‘Search’ button.

- Type the characters that you see in the captcha image before clicking on ‘Search’ button again. You can now be able to see the dealer’s information if you used the correct GST

Business entity is acquired by the NRI person to help work in and out the state. They show a unique number to help the government recognize the person.

How to GST Login into www.gst.gov.in?

How to Logon into GST Login at www.gst.gov.in

Navigate to the GST website: https://www.gst.gov.in/. On the menu bar ‘Login’ button will be available. Click on it. In the login box you can write username and password. On the box there is no Captcha code everyone can click on the Login button. You will get a message of successful login and all the details which is needed about the GST.

How to file GST Online Application Registration for NRI

Key in the name of applicant but be care to write as it is on the passport. The applicant has access of the portable to applying the GST REG-09. This should be 5 days before starting the business. Give your email address and valid mobile phone number to help in communication. An OTP will be send on both the mobile and the email this will help to fill in part 2 of the form. A photo to be scanned and pasted on the declaration. The application has to be filled online using the new system of electronic verification code.

Who are eligible for GST?

Business which earn more than 20 lakhs and some states like Himachal Pradesh and J&K range is 10 lakhs. If an individual is registered under the pre-GST law. Any common citizen or foreigner who is taxable. Person distributing any goods and services. Citizens paying their tax under the reverse charge mechanism. Anybody using the online transaction to get information or do business.

What are the Documents to Provide when Registering?

You need the pan card for registration and Aadhaar card. Your business registration form. ID and the address proof for your promoters. You need a bank statement and Signature. A letter from the authorization.

What are the Benefits to Traders?

The GST has reduced range of taxes impacted on the goods and services. The rates have been neutralized on the export goods thus suiting the trader. The taxes are much simpler for them too. They have a common market. There are lesser rates and exemptions. You don’t have to differentiate between goods and services.