Now Pay your Bruhat Bengaluru Mahanagara Palike BBMP Property Tax Online or Karnataka Property Tax Online and also check the BBMP Property Tax payment status at bbmptax.karnataka.gov.in…..

Every government needs to collect tax from citizens for the smooth running of the country. There are different types of tax that a government may administer depending on your country of residence. One of these taxes is Bangalore property Tax, a local tax that municipal authorities collect from property owners. This tax is very important as it helps in maintaining the services and basic civic facilities of a given city. These basic civic facilities include sewer systems, light posts, parks, and roads just to name but a few.

Tax is considered as the backbone of the Indian country. It acts as the revenue of government and pays the government employees. Majority of the country’s developments and projects all rely on the tax paid by the citizens.

Payment of the BBMP property tax

- The tax year always begins at April and ends at March. You pay tax on 30th April of the financial year.

- If you pay your property tax within the given time and before the BBMP gives you 5% discount.

- Every delayed property tax has and interest attached to it of 2% and for the whole year the interest accumulated is 24%.

- You have the option of paying two times but there will be no interest gain or discount offered.

Details every tax payer should know before making the payments

When it comes to new tax payers you need to learn about your property. Don’t pay blindly learn about the tax and how to pay the value of your property?

- Learn the value that your property holds.

- Before paying know the type of your property: commercial, residential, go-down etc.

- Where is the property classified?

- Give the dimension of your property.

- The number of floors plus the basement.

- The area your property has taken.

How to pay BBMP property tax or Karnataka Property Tax Online at bbmptax.karnataka.gov.in

Online method

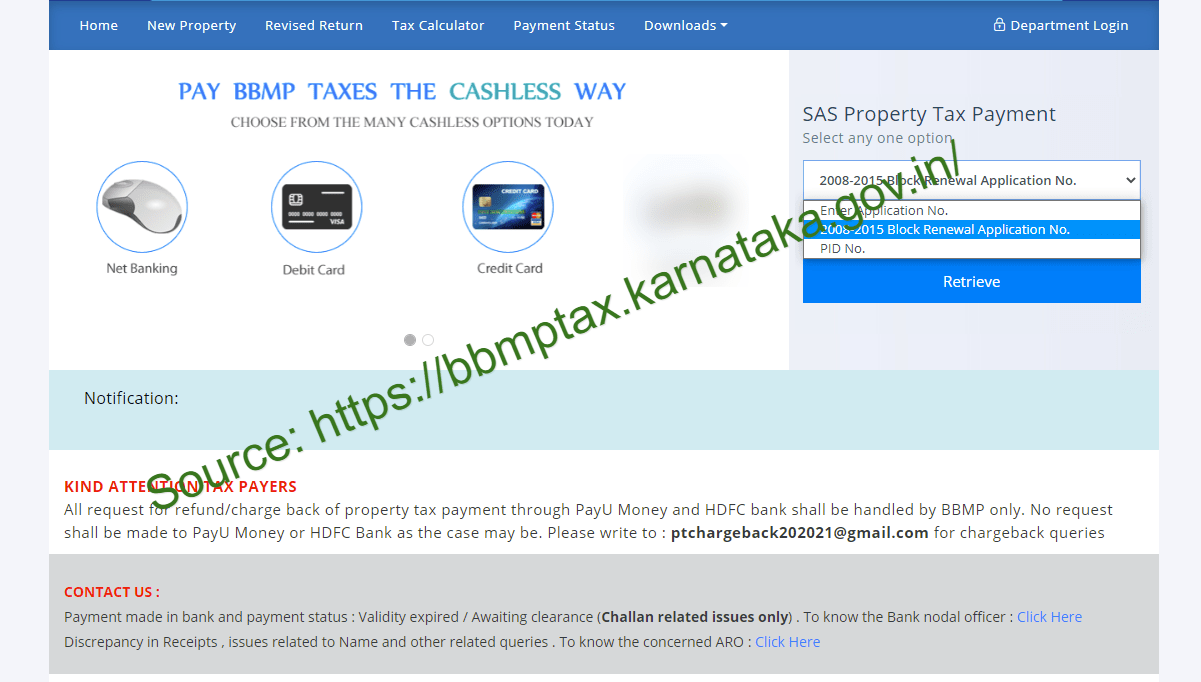

- Enter http://bbmptax.karnataka.gov.in/ as the official link for accessing Bruhat Bengaluru Mahanagara Palike (BBMP) Website.

- Press the ‘Enter’ button on your keyboard after typing in the above link correctly. This action will redirect you to the homepage of BBMP website.

- Next, select ‘SAS Base Application Number’ from the box containing this detail. You will then have to enter your ‘Base Application Number’ in the box set aside for this information.

- Click on ‘Fetch’ button after keying in your Base Application Number. Property owners who do not know their application number can click on ‘Renewal Application Number’ option.

- You will then have to enter your previous year’s application number for SAS. The owner’s name will then appear on your screen. Click on ‘Confirm’ button if the details are correct.

- A new page containing the details of your property will appear. These details include Status of Tenancy, Property Occupancy and area. Carefully examine these details before ticking on the checkbox.

- Click on ‘Proceed’ button to see Form V of the property tax. You can then make any changes to your property details before clicking on ‘Proceed to Next Step’ button. You will now be able to see your property tax calculation based on the details that you have just submitted.

- Click on ‘Proceed’ button after having a look at your tax calculator. You will then have to make the payments online or using Challan that you deposit at the ward office of BBMP.

- Select ‘Property Tax Payment Online’ option to make your payment via the portal. You will have to select the payment method that you wish to use i.e. Net banking, e-Wallet, Credit Card or Debit Card.

- You will receive a receipt after making the payments successfully. However, it can take close to 24 hours before your electronic receipt is generated.

- Finally, download the electronic receipt by clicking on ‘Download’ button.

Offline method

Individuals who want to use the offline method have to fill the form as per their property. Fill all the details correctly. Take the forms to the bank which have same deals with BBMP. You can also take the forms at the BBMP ARO and make the payments.

How to Track BBMP property tax Payment Status at bbmptax.karnataka.gov.in

- Enter https://bbmptax.karnataka.gov.in/ on the search bar of your installed browser. This is regardless of whether you are using Google Chrome, Internet Explorer or Mozilla Firefox.

- Press ‘Enter’ button to initiate the search process.

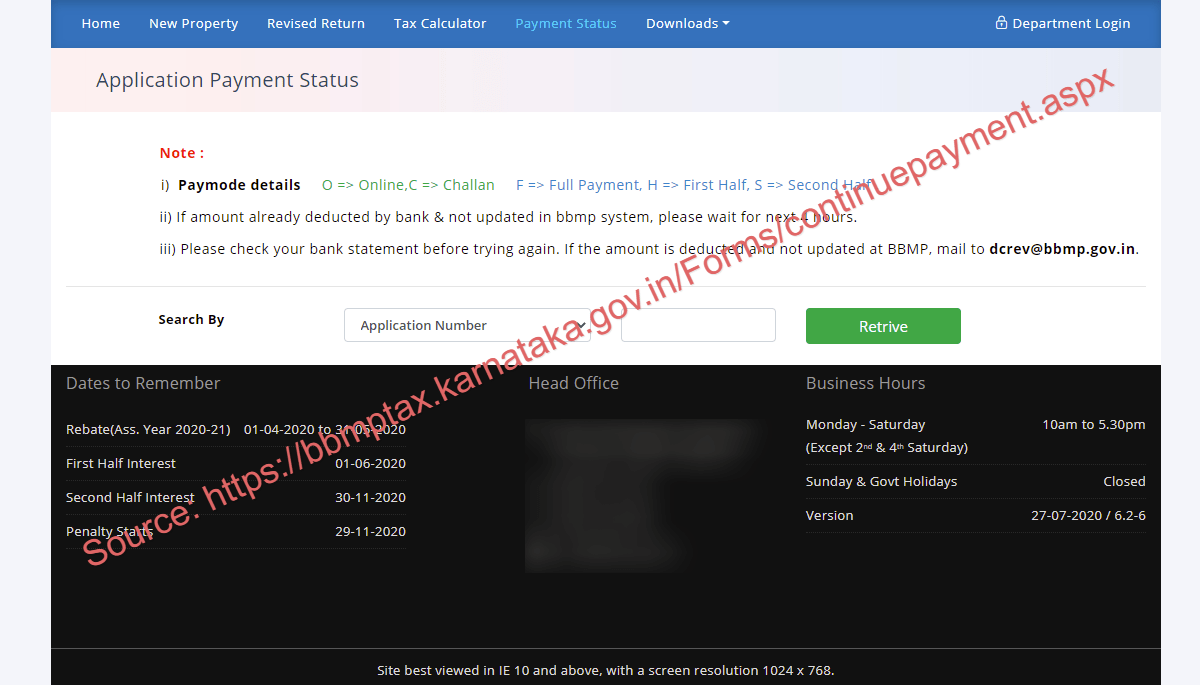

- You will be redirected to the home page of Property Tax System website from where you should click on ‘Payment Status’ option.

- The payments status page will appear on the screen of your device. Here, select the option that you wish to use when checking your payment status i.e. Application Number or Challan / Transaction number.

- Enter your application number if you decide to use this option.

- Finally, click on ‘Retrieve’ button to complete the process. You will now be able to see your payment status details on the new page that will appear.

How to calculate the Bruhat Bengaluru Mahanagara Palike BBMP Property tax

Property owners in Bengaluru can now calculate their tax online without seeking the help of friends or BBMP officers. This has been made possible thanks to the ‘Tax Calculator’ service available in BBMP Website. The following steps will help Bengaluru property owners calculate their property tax.

- You will first have to know the exact details of your property i.e. Depreciation, Value per unit area and built-up area.

- Next, multiply the value of unit area with value of the built-up area. You should then multiply the result with 10 (Denoting 10 months).

- Now deduct the depreciation from the value that you get above in order to generate the total annual value of your property.

- You will have to calculate 20% of the annual value of your property. This action will generate the property tax value.

- You will then have to calculate 24% of Property tax value to get the cess amount.

- Add up the Cess amount to the property tax. You will arrive at the final property tax amount to be paid.

- Any property owner who wants to know the discount tax amount will have to deduct 5% from the final calculation.

How to print Karnataka property tax at bbmptax.karnataka.gov.in

- Visit the BBMP Portal: https://bbmptax.karnataka.gov.in/

- On the home page go to the menu select Print application.

- Look for the assessment year on the drop down list.

- Key in the application number.

- Submit the details and wait.

- Now click on the print application

How to print BBMP property tax challan or Bangalore Property Tax Challan Print at bbmptax.karnataka.gov.in

- Navigate to the homepage of BBMP website: https://bbmptax.karnataka.gov.in/

- On the menu select print the challan.

- Look for the assessment year.

- Fill in the application number.

- Submit the particulars.

- Print out the Challan.