Brief Guidelines on How to Signin E-way Bill Login at ewaybill.nic.in website and How to Generate Eway Bills online…

EWay bill can also be produced through an SMS, you can cancel all process on the portal through a SMS from a registered mobile number. This can be achieved using site-to-site integration or Android app. If anyone generates a EWay bill the system will give a unique number which is eligible to supplier,recipient and also the transporter.The receipt generated is referred to as E-Way bill number (EBN). This type of receipt contains all details and movement of goods from one point to another. Every route and where they are designated to go are included on the EWaybill.

Who are eligible for E-way bill?

- Registered Individuals: If you are registered under the GST whether as a consignee or consignor you have to give the Eway bill. The state government made it compulsory for any goods beyond Rs.50,000/-.

- Non-Registered: If any of the parties is not register the other person should stand in and complete or the details need by the Eway bill rules.

- Transporters: All transporters have produce Eway bill to take goods to their destination. If the supplier hasn’t registered then transporters can take step to have the eWay bill.

E-way Bill login or Eway Bill GST Login procedure into ewaybill.nic.in

- Navigate to main web portal: https://ewaybill.nic.in

- The home page will appear key in your username, password, and also the captcha code. Select login.

- After it will go to this URL: https://ewaybillgst.gov.in/login.aspx

- Now click on the new generate option which is on the menu bar under the Eway bill.

- Fill in transaction type: for individuals who are suppliers select outward.

- Sub-type: they vary according to the type you choose.

- If you choose inward: the recipient of the goods.

- Document type: there are different type’s example challan, bill, invoice and many others.

- Document No: this the number written on the receipt.

- Document date: get the date written on the challan or invoice. Remember don’t enter future dates as the system will not accept.

- The date will be filled according to either the supplier or receiver. To / from or from/to.

- Some clients are not registered you need URP in the GSTIN.

- Have the following details: The name of the product / good, The description, Quantity, Units of the goods and The taxable & non-taxable value.

What is Transporter ID under the GST?

This a unique number which is given to different transporters. It represents a registration numbers and different for each transporter. Note if the goods carried are more than Rs.50,000/- it’s mandatory to have Eway bill. The transporter has to be registered either by GST or the Eway bill. The Eway bill is easy to produce just use the vehicle number and in few seconds it out.

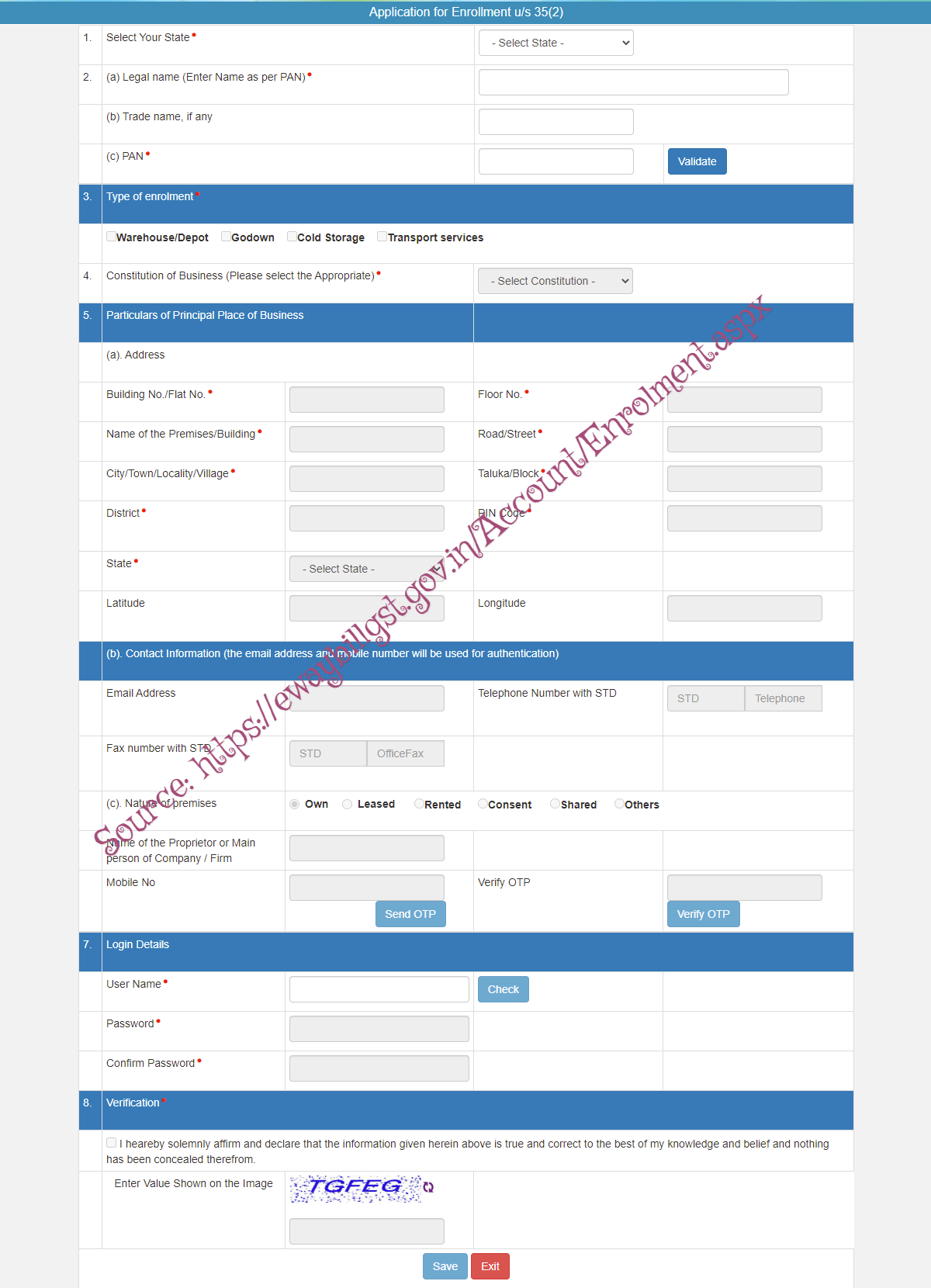

How to Register for transporter ID in ewaybill.nic.in website

- Enter https://ewaybillgst.gov.in on the search bar of your browser. Press the ‘Enter’ button on the keyboard of your browser to start the search process.

- Place your mouse cursor on ‘Registration’ option and then click on ‘Enrollment for Transporters’ option.

- You will be redirected to a new page from where you should select your state. You must also fill in your legal name, trade name and PAN.

- Select the type of enrollment.

- Correctly fill in the particulars of principal place of business. These particulars include Address, latitude, road and district.

- Enter your registered mobile number and email address that will be used for verification purposes.

- You will also have to fill in your Aadhaar details before verifying them using the OTP sent to your mobile number.

- Next, enter your login details i.e. User ID and password.

- Accept the terms and conditions before finally clicking on ‘Save’ to complete the process.

The transport has to take all valid documents to ensure the goods get at the destination on time. He / she should have the Eway bill at hard as proof, have valid ID card and the invoice of the supplies to be delivered.

How to generate Eway bills at ewaybill.nic.in?

How to generate Eway bill on official portal i.e ewaybill.nic.in?

You need to register on the EWB portal. The receipt must be in hand copy when delivering or transporting the goods. Transport must carry their own ID or vehicle number if they are using road. Transport by other means the transporter has to give the ID and also the transport documents number and dates.

How to print E-way bill at ewaybill.nic.in?

Go to the Main Homepage: https://ewaybill.nic.in. On the menu bar select the option of EWB on the eWay bill. Select the correct Eway bill number and select the go option. On the same screen take the print option.

Cancellation of Eway bill for goods to be transported

In case some goods are not transported the transport or the receiver can cancel the Eway bill. It can be achieve through sending an SMS. The process has to be done within 24 hours since the issue time. The Eway bill center can be notified directly to cancel the Eway bill.

Who has the power to accept or decline the Eway Bill?

The receiver can make choice either to accept the Eway bill or reject. But the system is set if the Eway bill is not picked within 72 hour auto-accepted. The official receipt will be on the website portal for you to download. Valid documents to carry by the transporters.