Prime Minister Employment Generation Programme Scheme of PMEGP Loan Online Application for PMEGP AP, Telangana, Gujarat, UP etc at kviconline.gov.in – PMEGP etracking System at msme.gov.in….

The PMEGP is a credit linked scheme of two conjoined support programs. This programs were operational till the year 2008, the two were joined to form the bigger Prime Minister Employment Generation Programme (PMEGP). The Prime Minister’s Rojgar Yojana (PMRY) and the Rural Employment Generation Programme (REGP) preliminary helped create employment through micro enterprises in the rural and urban areas. Actually the TG State provided Loans for SC / ST / BC categories and also everyone can get State wide PMEGP Loans like PMEGP Telangana, PMEGP AP, Gujarat etc…. Who want to apply for Telangana State SC / ST corporation Loans those citizens go to the https://tsobmms.cgg.gov.in/ website.

This new scheme by the Indian government is under the ministry of micro, small and medium enterprises. (MoMSME). However at the higher levels of the government the program is running under the Khadi and village industries commission (KVIC). This initiative will be taken through the KVIC which will join hands with several banks. The banks will assist in the distribution of the funds evenly to the accounts of the beneficiary.

The PMEGP scheme favors all groups of people, those from the marginalized communities, handicapped, and women ex-service men on those on border. They get a fund of 35% in the rural and 25% in the urban areas. This consideration as the other group of people only get 25% in the rural areas and 15% in the urban areas.

What was the aim / Scheme of PMEGP?

This programs was implemented for the good of the Indian citizens. Especially the youth and the traditional artisans. The basic idea was to bring the spirit of self-employment and empowerment both in the rural and urban areas.

Who are eligible and who are not

This scheme has certain conditions:

- Helps only new projects which have been approved by the authority.

- You have to be older than 18 years.

- No higher limit of funds when it comes to issuing the funds.

- Must have the eighth standard education level on the manufacturing sectors.

- The self-help groups are encouraged to apply.

- BPL families should apply but they can’t be holding any other scheme out there.

- Institutions are also eligible if they registered by the societies registration act.

- Charitable organizations.

Those who are not eligible to receive the PMEGP

The state government have given the specification of who will receive the funds. All individuals are applying for the loans/funds will have make good business proposal. Below let see who is not eligible and why.

- Companies dealing with prohibited substances like cigar, pan, beedi, liquor or meat.

- If you are going to deal with pashmina wool, or products dealing with hand weaving and it already a project by the Khadi program.

- If dealing with tea, coffee, horticulture, floriculture and animal husbandry.

- Rural transportation. However the bicycles, rickshaws house boats and tourist boats plus shikaras in Jammu and Kashmir are exempted.

- Any industry manufacturing hazardous items won’t be considered.

PMEGP e-tracking system

This is system introduced by the Indian government to bring transparency and clear data coverage for the beneficiary of the PMEGP loans. This helps curb corruption in the distribution of the funds.

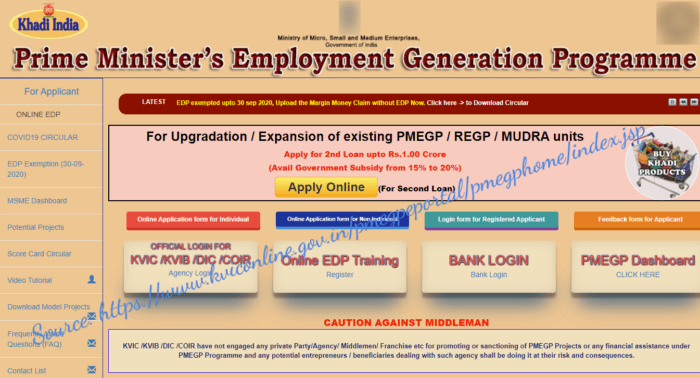

PMEGP online application registration at kviconline.gov.in/pmegp/

Using the given link https://www.kviconline.gov.in/ the interested candidates can apply for a loan through the simple process.

- Visit the official website page: https://www.kviconline.gov.in/pmegp/

- The page will open and on the menu bar you find “PMEGP online application”.

- Click on this option and a new page will appear.

- The new page will give an option of “online application submission”. Open the link.

- Fill in the details on the page, carefully.

- Now you will get other option of “preferences for sponsoring agency and office”.

- Here fill in either the state, district or agency and select the legal type.

- Now fill your name, Aadhaar card number, date of birth, gender, fathers name and communication address.

- Enter the proposed location of the PMEGP, the bank particulars qualification and social category.

- Recheck all the details make corrections if need be.

- Now click on the submit button.

- Note all this fields are mandatory.

How to Track PMEGP Application status using the Pmegp etracking status at https://my.msme.gov.in/

This a process you take after you are done with applying the loan.

- Navigate to the official website: https://www.kviconline.gov.in/

- The page will open and you will find “PMEGP e-Tracking system”.

- Below this word you will find “official login” and “application status view”.

- Enter the details as instructed then submit.

- The application status will show on the screen.

- You can also login with your user ID and password.

- The id and password should be a secret and nobody should login or use it to check the status.

How to prepare the PMEGP beneficiary list

- The list is done and under taken at the district level by few members from KVIC. The district magistrate / deputy heads the task.

- The KVIC is supposed to prepare the score card.

- This card will determine whether you get the loan.

- The score card will be placed online.

- Check whether you are qualified.

PMEGP Loan interest

For the normal rates there are no interest charged. However the payments will be done between 3-7 years. This is flexible period for the youths and the beneficiaries to pay and grow their business.There is a grace period of 12 months before the first payment.

The beneficiary should use the loan given well and for the plans he/she indicated on the proposal. Failure to this the officers in charge will add an interest on the loan as punishment.