Registration Procedure on creating an account in psb loans in 59 minutes website www.psbloansin59minutes.com…..

PSB loan in 59 minutes policy is very clear to you now. So have you made up your mind to take a loan with PSB loans in 59 minutes? Do you wish to apply online for this loan without requiring you to visit different centers? If this is the case, you can easily do so. For this, you just need to make a registration on the portal.

How to Create an account of Psb Loans in 59 minutes website psbloansin59minutes.com

The process of registration is quite simple. Just follow the below-defined steps to register yourself .

- Go to the official portal of the PSB loans in 59 minutes. The link is https://www.psbloansin59minutes.com/home.

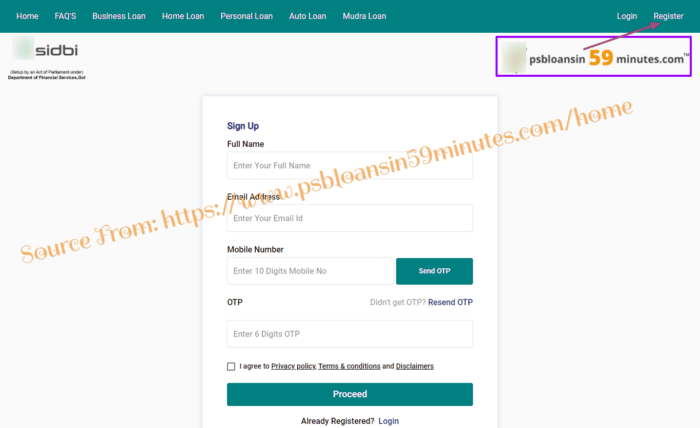

- Now on the home page of the portal, you will find an option to ‘Register’. Click on ‘Register’ tab.

- When you do that a Sign-Up form will appear. In this form, you will be requiring to fill in the details such as name, the email ID and mobile number. Remember, you need to verify your mobile number by typing in the OPT in the OTP box that is present just below the Mobile No. box. After you have filled in the OTP, tick the check box agreeing to the privacy policy etc. At last, click on the ‘Proceed’ tab.

- On the new page, you will need to provide your data and then select the banking partner. Finally, you can get the approval as well. On the very first page, you just need to answer four simple questions in Yes or No. The questions would be:

• I am registered with GST

• I am regular in filling my GST returns

• I have filled my last 3 years income tax return (ITE 3.5.6)

• I am regular in my loan repayment and not defaulted in past

Answer these questions with honesty. You will be caught anyhow in the end, if you have entered any false information. Agree to the disclaimer and terms in the end and then click ‘Proceed’.

- Now enter your GST number, UN and password. Once you have entered them correctly, click the ‘Submit’ button.

- After all this, you will be required to upload the required files and document. There will be different boxes to upload different files. The files must be uploaded in the XML format. The documents required are GST returns, ITR returns etc. We will discuss the documents required later. Once you have uploaded the required documents and have filled in the PAN information, click on the ‘Submit’ tab.

- In the next step, you will be required to enter the bank account details. For this, you must first keep the scanned copy of the bank statement ready with you. If you have the scanned copies of the bank statement, upload them here. If you do not have the scanned copies of the bank statement, there is an option to Log in to the bank account through internet banking and send the details to the portal from there only. Not even for a second, you need to think of the security of this process. It is assured that the data remains protected.

- Once you are done with the bank statement work, it is now the time to fill in the details about your company like address, related properties, director, proprietor etc. Fill in the correct information and then proceed further.

- You are now close to complete the application process. Just explain in detail about why you need a loan. Together with this, you also need to specify if you have already taken a loan before and what the type of that loan is.

- Now you will be taken to option 2. Now you need to choose the preferred bank from which you wish to take the loan. Choose the bank wisely and then click on the ‘Proceed’ button.

- On the next page, you have to pay a convenience fee. The fee is Rs. 1000 and you have to pay GST on that. You need to make all of this payment online.

- After the payment, you will see a screen, congratulating for the successful registration. If you wish to download the approval letter for the loan, you can download it from here.

Note: In some cases, it happens that the portal requires you to fill in some more details about the company on the basis of the bank you have chosen. Please fill in those details on the portal or quick processing of the loan.