Step-by-Step Procedure on How to Generate / Download Kerala Government Employee Salary Pay Slip Online at https://wps.lc.kerala.gov.in/ website…..

Today focusing on the Wage Protection System WPS Kerala is an online portal for the labor commissioners. It helps in the government financial details and transactions. It is through automatic process for all the stakeholders and the agencies linked to the government.

Deeply the wps.lc.kerala.gov.in portal works to see the processing of salary and minimum wage. The portal ensures all the transactions are done online. With this all the documents are safe and employees can follow up on the pay slips and statements.

What the purpose of the wps.lc.kerala.gov.in website? The site was established to cater for the worker’s salary slip, pension and also GPF which is general provident fund.

How to Generate Kerala Government Employee Salary Pay Slip online at wps.lc.kerala.gov.in?

The Kerala employees both in the private and government sector have to be registered in the Labor commissionerate. This will help them get access to the WPS website. Here they can check their Salary Slip and GPF. Every monthly salary is sent to the employee account through the online method.

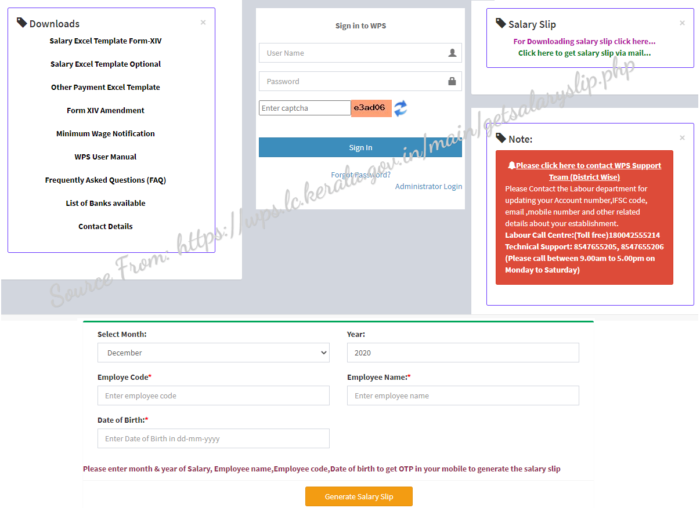

- They use a special link: https://wps.lc.kerala.gov.in which is under the labor commissionerate of the Kerala government.

- Navigate to the official WPS website: https://wps.lc.kerala.gov.in/

- On the homepage enter the password and username.

- When done enter the Captcha code carefully on the space provided.

- Now you can click on the sign in button.

- The site also gives a chance to those who have forgotten their password.

- Click on forgot password tab and be directed to simple steps which will help you recover the password.

- On the menu bar when you login, go to the monthly salary slip record.

- Now click on the Download Employee Salary Pay Slip.

- The system will ask for the following options: month, year of the salary, employee code, employee name plus date of birth.

- Recheck all the details and the select the generate salary slip.

- After the selection the website will send you and OTP on your registered mobile number.

- Use the OTP to generate the pay slip, now enter the OTP on the appropriate space then press the submit button.

- You can download or print the salary slip.

- Additionally you can send the slip to your valid email address.

- Go to the official website and use the link.

- Enter the employee code, name date of birth and Captcha code.

- Now select the generate salary slip.

- Automatically the slip will be sent to your valid email address.

Note: Direct Link to download Kerala Government Employee Pay Slip online at https://wps.lc.kerala.gov.in/main/getsalaryslip.php

Services available in the wps.lc.kerala.gov.in

The site has various services attached to it as follows.

- The salary Excel template form XIV

- Salary excel template optional.

- Form XIV amendment

- Information on minimum wage.

- WPS manual

- The frequently asked question

- Last but not least the monthly salary slip.

The labor department of Kerala has different functionality. They have introduced a system where the shop and business people can register their business. The registration happens every year 30 days before the actual expiry date.

Procedure for registration of establishment for the shops and commercial establishment act.

One shall fill different forms with the following guidance:

- First one need to fill the application form B1 of the labor registration.

- Carry with you the original Challan of payment from the treasury office.

- Take Challan and the form to the labor office assistant.

The labor commissionerate has ensured all service in the Kerala state are done online. The renewal of licenses, application and registering also included on the WPS website portal. All the shops and commercial establishment act use the following link: http://www.lc.kerala.gov.in/

Registration procedure

- Navigate to the official website page: https://wps.lc.kerala.gov.in/main/index.php

- When the labor department opens go to the online registration button.

- The online registration has instruction which one should follow after reading this now press the proceed button.

- Now click on the Kerala act of registration, written as Kerala shops and commercial establishment act 1960.

- On the new page now select the district name and registration office.

- You have to fill in the mandatory information as follows: Name of the employer and manager this only applies if the company has any, Give the name and postal address, Name of the employment which is the type of business, The number of male and female workers and the mobile number of the business owner.

- After entering the information above recheck and the download the employees details format.

- Then save the excel sheet in your PC.

- When the excel sheet pen now fill the following details: Name of employee, Address , Designation, Age and Year of joining.

- Save all this details

- Now upload the employees’ details on the browse tab. The details though are saved in the above steps.

- Now verify the details and then submit application.

- The system will approve the information and then send a feedback of application number and the temporary number.

- You can download the application and the challan after this you need to go to the online services where it will lead you to the home page.

- Again select the print application then enter the temporary registration number.

- Select the show button, note here you can press on the download application.

- Update the status of your payment on the same website after paying at the treasury.

How to create WPS SIF file manually?

This a legal file known as the Salary Information File (SIF) it used to generate file which is used by the windows. Here you can transfer the salary and wages of your employees. The details have to be linked to a bank. Here we have few steps of creating a SIF.

- First go to your browser and open a new salary file it should be on excel sheet.

- Now fill in all the mandatory information about the employees.

- Fill in the id number of the employee this number is given by the labor commissionerate. Note if the number is less 14 digit one should zeros.

- After this fill the account number of the employee or he salary id for the bank where the salary will be sent.

- Agent id from the bank your salary is credited

- Now give the date by which the payment will start in the format of yyyy-mm-dd.

- Fill in the days of the month which the salary is being paid for.

- Now fill in the fix income amount which should be paid to the employee.

- Enter the overtime and extra payments to be paid plus all the leave days.

- Now save the file as CSV file then rename the file as the SIF file.

This the last part of the procedure you have to fill all the employer details.it is known as the Salary Control Record (SCR).

- First type on the page: SCR

- Fill in the 13 digit employer id which is a number given by the ministry of labor.

- Enter the bank code it is a 9 digit number for the employer. The bank in which the salaries are credited to provides this code.

- Now fill in the file creation date: yyyy-mm-dd.

- Fill in the time when the creation file was formed. it should look like HHMM 4:56 pm to appear as 1656

- Enter the month by which the salary is being produced. Example the month of November 2018 it will appear as 112018

- Now enter the EDR count, this just the number of employees in the company whom will receive the salary.

- The employer should fill in the total amount to be paid enter the money / currency

- Lastly enter the employer reference number.

- Save the file as the CSV then change it to SIF